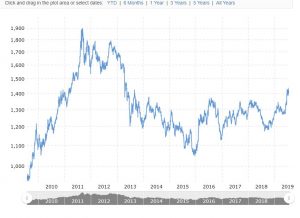

In the past, the highest price of gold ever in Canadian Dollar terms was $1883.07 in mid-2001. Today (August 25th) it is around $2060 per ounce. (Check Today’s gold price here ) – above that long-standing that record high. So, why is the price of Gold at record highs against the Canadian Dollar? What is driving this trend?

1) A Relatively Low Canadian Dollar

One key factor is that the Canadian Dollar is somewhat on the weak side compared to historic averages. We are not near the historic lows of around 65 cents we saw from 1999-2003, but for most of the last year, the Canadian Dollar has been in the mid to low 70 cents to the US Dollar. far off the close to parity we saw from 2010 – 2014.

The Canadian Dollar has historically been tied to the price of oil, and while crude prices have been climbing since mid-2017, from about $50 per barrel to pushing towards $70, the Canadian Dollar has not followed the increase yet. Part of this could be transportation constraints and a lack of demand from our main export target, the US.

Provincial Governments in Ontario and particularly British Columbia have also been implementing changes to cool what they see as over-heated real estate markets. Real Estate has played a strong part in these economies over the last few years, particularly in bringing in foreign capital. It remains to be seen how resilient these economies will be to factors such as vacancy and foreign buyers’ taxes.

So, a big part of this story is the relatively weak Canadian Dollar, and this pushed the price of gold higher in Canadian Dollars.

2) The price of gold has been rising.

Key drivers of the price of gold have historically been real interest rates, the US dollar, and risk aversion, or the need to hold gold as an investment as investors look for a commodity that will not lose value.

The US Dollar has also been seen as a good investment and is a major competitor to gold. It is often being impacted by trade and political uncertainty. Whether this uncertainty is more or less than historic averages is anyone’s guess. One week Iran in seizing oil tankers, the next week either or both China or the US are imposing new tariffs on each other. There are always threats and opportunities with the US on the world stage that could impact the value of the US dollar and its attractiveness versus gold as an investment. Some will have staying power; some are just this week’s news.

One long term factor that is impacting the price of gold is the growing demand for gold jewelry China, India, and other populous, rapidly developing countries that are becoming more affluent. Jewelry is the largest source of demand for gold, and we increasingly have people in these very populous countries looking to gold as an investment. Long term, this could push gold prices.

US interest rates spent much of the beginning of this decade at historic lows, pushing up the demand for gold as investors looked for commodities with better returns. Since early 2016, US interest rates have been steadily climbing, and it remains to be seen where the “new normal” will land as strong US economic growth could be leading to upward pressure on interest rates, while the US Fed has signalled it may keep interest rates down.

The last time gold was above $1400 USD for more than a few days was in May 2013 when the Canadian Dollar was in the mid-90 cents to the US Dollar, and in fact, most of the time gold prices were high from 2010 to 2013, the Canadian Dollar was at, or just below parity with the US Dollar. This time, the Canadian Dollar is much lower against the US Dollar, and that has resulted in putting Gold at record highs, historically, in Canadian Dollar terms.

These are, as we see it, the main reasons why gold at record highs, all-time, against the Canadian Dollar. It is likely an excellent time to take advantage of the opportunity to cash in on any gold jewelry, coins, or investments you may have. As always, it is hard to say what the future holds. Will higher oil prices and more access to world oil markets or a change in government bring Canada’s dollar back up and gold prices down compared to the Canadian Dollar? or will continued increases in demand from industry and consumers in growing economies and political uncertainty around the world continue to push gold prices up? No one knows for sure, but that is the challenge of being an investor.

—