Professional and Transparent.

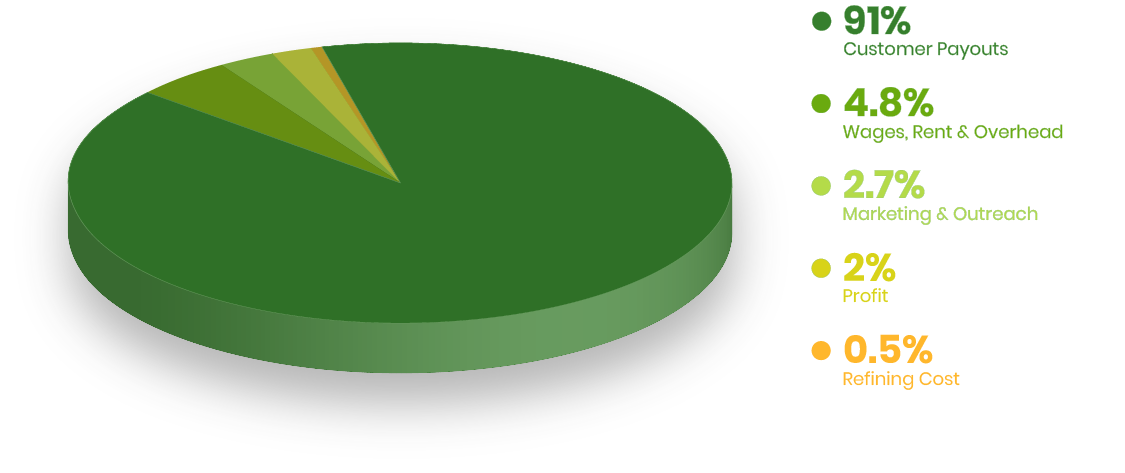

Our Pricing Model: Our Analysis of Gold Purchases in 2017*:

91% ends up in our customers’ hands.

How do we set our prices?:

Our pricing strategy for various gold and silver items is meticulously calibrated, with updates occurring every 20 minutes to align with the prevailing market rates for gold and silver bars. The benchmark for these rates is established against the bullion market spot price, which is set at 400 ounces for pure gold and silver bars.

We offer all gold and silver products at wholesale value, relative to the expenses associated with transforming the coin into gold and silver bars. For instance, gold in its natural state requires extensive mining and refining efforts, hence it is priced lower compared to refined gold in its pure form. Our wholesale values are structured accordingly, with prices typically aligning with or closely approaching the spot market price for gold and silver bars. The rates are slightly reduced for standard coins and bars from various mints, and further discounted for jewellery.

Unlike other entities in the industry, we do not impose any additional fees or commissions on top of our listed prices. What you see is precisely what we offer. Our profit margins are modest for each transaction, as depicted earlier, and our business model thrives on the volume generated through returning and referred customers. This stands in stark contrast to many conventional players in the industry who prioritize maximizing profits in each transaction.

Furthermore, all our assessments are conducted free of charge. Should you choose to sell, we guarantee instant payment on the spot!

Why not 100% of gold spot market price for the gold in my jewellery?

There are 3 main reasons why we, and other buyers, cannot offer 100% of gold market value for jewellery.

Risk

Dealing with jewellery presents inherent risks and potential margins for error in both design and evaluation, unlike trusted coins and bars. We acknowledge that some jewellery labeled as 10K, 18K, etc., may actually have slight variations such as 9.5K or 17K due to potential errors in purity measurement by jewellers, whether intentional or unintentional. This margin for error is further compounded for unstamped items.

While our measurement techniques are highly accurate, we understand the possibility of discrepancies between the stamped karat and the true purity of the item. In cases where the true measurement closely aligns with the stamped karat, we err on the side of generosity and offer prices equivalent to 10K for items that may actually be 9.5K, for instance. This practice contrasts with others, particularly mail-in buyers, who may not extend such leniency.

Our analysis has revealed that stamped items, upon refining, may exhibit errors ranging from 2% to 7%. These slight variances often result in bonuses, meaning we may end up paying more than our posted prices for the actual gold weight. It’s noteworthy that we’ve never encountered an item stamped at a particular karat that measured at a higher purity, ensuring that we always pay at least the true karat value.

Additionally, there’s a secondary risk associated with exposure to fluctuations in the gold market price. Given the approximately two-week turnaround time for our refining process, gold prices can fluctuate by 1% to 2% during this period. However, this risk is factored into our pricing structure to ensure fairness and transparency for our customers.

Refining

The expenses associated with refining items are already incorporated into our prices, a cost that is unnecessary for pure coins and bars. It’s important to note that refining costs are also factored into the prices offered by other buyers. However, since we handle the refining process ourselves, our refining costs are nearly half of what other local buyers typically charge.

Even if a buyer intends to resell purchased items, they are likely to focus on reselling only exceptionally valuable pieces. Therefore, the majority of their inventory will also undergo refining in a similar manner.

Should we come across a valuable coin in your collection that surpasses its gold or silver worth, we will inform you accordingly and refrain from purchasing the coin if you prefer.

Reality

The reality is that Canada Or is a company committed to providing a professional service, and naturally, there are costs associated with delivering this service. These costs are factored into our prices:

-

Marketing: We invest in marketing our service to ensure that you are aware of our existence and can take advantage of our competitive prices. Without this awareness, you might be compelled to seek services elsewhere.

-

Professional Office: We maintain a professional office environment to ensure that we are always ready to serve you whenever you are ready to sell your items.

-

Modest and Fair Profit: We aim to generate a modest and fair profit to compensate for our investment of time and funds, which are held until the conclusion of the refining process.

It’s important to note that our payment far exceeds industry standards, as we approach the transaction as a currency transaction rather than a mere cash seizure. Despite the costs associated with refining items, as well as covering modest office and marketing expenses, our profit margin remains low. Additionally, the fees linked with refining items can render the process inaccessible to individuals with only a handful of items. Refining becomes profitable only when processing large volumes.

Our prices are meticulously set to ensure that we can offer you the highest amount for your gold and silver while still maintaining profitability. By dealing in large volumes, we can provide you with the highest returns possible.

We offer higher prices for 24K bars and coins compared to 24K jewellery, a practice not commonly offered by other gold buyers. This disparity is attributed to the inherent risks and potential margins of error associated with jewellery, which are absent when dealing with trusted bars and coins. When we handle a trusted bar or coin, we possess precise information regarding its weight, purity, and gold content.

While we operate with efficiency, the costs associated with maintaining our office, covering marketing expenses, and refining precious metals leave us with a narrow profit margin of approximately 1-2% for trusted coins and bars. For instance, we pay close to the spot price for the one-ounce Canadian maple leaf since it does not incur refining costs. This coin, being a true pure coin, is highly desirable for investors.

Our pricing structure is meticulously calibrated to ensure that we can offer you the highest amount for your gold and silver while still turning a profit. By dealing in large volumes, we are able to provide you with the highest returns possible.

Our place in the industry

In comparison to the industry, we stand out in several key aspects. While there is some competition from pawnbrokers, jewellers, postal websites, and mall kiosks, our approach distinguishes us:

-

Transparency: Unlike many competitors, we prominently display prices per gram on our professional website. This transparency ensures that our customers are well-informed and can make educated decisions.

-

Fair Negotiation: We avoid engaging in negotiations where buyers attempt to offer as little as possible. Our pricing structure is designed to be fair and upfront, minimizing the need for haggling.

-

Vigilance: When we encounter offers seemingly higher than ours, we thoroughly test them. In doing so, we have often uncovered fraudulent offers or hidden fees buried in the fine print. Our commitment to transparency ensures that our customers receive the value they deserve without any surprises or hidden costs.

-

Consistency: Throughout our operations, we have consistently delivered on our upfront offers. Customers can trust that the price we initially present is the price they will receive, without any unexpected deductions or changes.

In essence, our commitment to transparency, fairness, and consistency sets us apart in an industry where such qualities are often lacking.

Understanding the competition

When navigating the market, it’s essential to be aware of the various players and their respective practices:

-

jewellers: Typically charge fees for services such as appraisals and stone removal. While they may offer to purchase stones, the prices offered are often minimal. After factoring in fees and the value of stones, their offers tend to be substantially lower than advertised.

-

Mall Kiosks: Offer lower prices, often justified as a convenience for selling in malls.

-

Pawnbrokers: Operate by offering the lowest amount they believe you will accept. They may entice you with higher redemption requests, but unless you are well-informed about the exact value of your items beforehand, you are likely to be underpaid in negotiations.

-

Postal Websites: Can be difficult to navigate, and the offers received may not align with what was promised on their website.

-

Hobby Buyers: Typically meet in informal settings like local cafes, and their prices are not fixed. It can be challenging to locate them after the transaction is complete.

-

Professional Buyers like Ottawa Gold: Offer higher prices within a professional setting, prioritizing transparency and fairness in their transactions.

By understanding the practices of each player in the market, individuals can make informed decisions when selling their precious metals.

Awesome customer service. The place takes a different approach to buying gold. Clean and modern atmosphere, no pressure and haggling required as they have all their pricing up front. Well recommended. – Google User Review

I found the staff both pleasant to deal with AND extremely knowledgeable! It was my first time into a gold buying store and I instantly felt at ease and comfortable. I will definitely be back with any other gems I find. Thanks to Ronan and his fabulous team!! – Vicki, Google User Review

Canada Gold sells diamonds graded by the Gemology Institute of America: the leading experts of diamond analysis and grading. Find out how much your diamond is worth here.

Canada Gold sells diamonds graded by the Gemology Institute of America: the leading experts of diamond analysis and grading. Find out how much your diamond is worth here.